Time magazine laid out a list of the recession's biggest budget-busters.

President George W. Bush was in office as the economy began its slide into recession. He watched industries crumble, companies fall apart and millions lose their jobs.

President George W. Bush was in office as the economy began its slide into recession. He watched industries crumble, companies fall apart and millions lose their jobs.Who else can we blame?:

Financier Bernard Madoff is accused of running a $50 billion Ponzi scheme through his company, which included Kevin Bacon and Sandy Koufax as investors. The notorious Madoff pulled off the biggest swindle in history - and nobody knew until all the money was gone. Time magazine had him on their list.

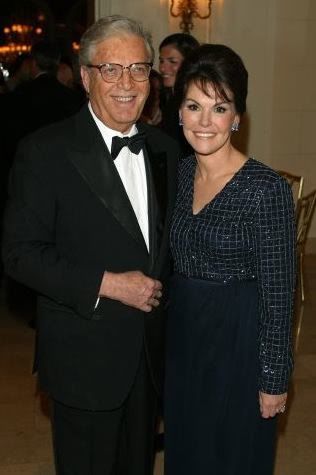

Financier Bernard Madoff is accused of running a $50 billion Ponzi scheme through his company, which included Kevin Bacon and Sandy Koufax as investors. The notorious Madoff pulled off the biggest swindle in history - and nobody knew until all the money was gone. Time magazine had him on their list. Ex-Citigroup CEO Sandy Weill led his company to financial ruin - and $45 billion in government money has done little to bail out the flailing bank. Weill has since been accused of wasting corporate resources for personal reasons, like a recent trip to Cabo San Lucas, Mexico.

Ex-Citigroup CEO Sandy Weill led his company to financial ruin - and $45 billion in government money has done little to bail out the flailing bank. Weill has since been accused of wasting corporate resources for personal reasons, like a recent trip to Cabo San Lucas, Mexico. The former CEO of Countrywide, Angelo Mozilo was criticized widely for the extravagant pay packages he gave himself during his tenure with the firm. When Countrywide was sold to Bank of America in 2008, B of A spent more than $8 billion to settle predatory lending charges against Mozilo's firm.

The former CEO of Countrywide, Angelo Mozilo was criticized widely for the extravagant pay packages he gave himself during his tenure with the firm. When Countrywide was sold to Bank of America in 2008, B of A spent more than $8 billion to settle predatory lending charges against Mozilo's firm. Chinese Premier Wen Jiabao gave the United States a boatload of cheap credit at the beginning of the economic crisis, and his country holds more than $1.7 trillion in dollar denominated debt, Time reports.

Chinese Premier Wen Jiabao gave the United States a boatload of cheap credit at the beginning of the economic crisis, and his country holds more than $1.7 trillion in dollar denominated debt, Time reports. Former Federal Reserve Chairman Alan Greenspan was responsible for dirt-cheap interest rates and lax deregulation policies that led in part to the recession, Time says. Greenspan admitted last year that he was wrong in thinking financial markets could regulate themselves.

Former Federal Reserve Chairman Alan Greenspan was responsible for dirt-cheap interest rates and lax deregulation policies that led in part to the recession, Time says. Greenspan admitted last year that he was wrong in thinking financial markets could regulate themselves. Former Fannie Mae CEO Franklin Raines took the helm of the lending firm in 1999 and left the company in 2004, leaving in his wake a series of financial scandals and subprime disasters. Fannie Mae officially became a ward of the state last year.

Former Fannie Mae CEO Franklin Raines took the helm of the lending firm in 1999 and left the company in 2004, leaving in his wake a series of financial scandals and subprime disasters. Fannie Mae officially became a ward of the state last year. The former CEO of the Royal Bank of Scotland, Fred Goodwin earned the name "Fred the Shred" during the bank's heydays because of his ability to cut costs, Time reports. Now, he's known as "the worst banker ever" after leading the bank to its worst losses in U.K. corporate history.

The former CEO of the Royal Bank of Scotland, Fred Goodwin earned the name "Fred the Shred" during the bank's heydays because of his ability to cut costs, Time reports. Now, he's known as "the worst banker ever" after leading the bank to its worst losses in U.K. corporate history. Former Lehman Brothers CEO Dick Fuld ran his company to bankruptcy after pushing it deep into subprime lending and mountains of debt. The firm officially called it quits earlier this year - and the corrupt Fuld walked away with nearly half a billion dollars of compensation from his time with the company.

Former Lehman Brothers CEO Dick Fuld ran his company to bankruptcy after pushing it deep into subprime lending and mountains of debt. The firm officially called it quits earlier this year - and the corrupt Fuld walked away with nearly half a billion dollars of compensation from his time with the company. Ex-Chairman of the Senate Banking Committee Phil Gramm was largely responsible for the financial deregulation plaguing the economy today, Time says. Gramm played the leading role in reversing the Glass-Steagall Act, which separated commercial banks from Wall Street.

Ex-Chairman of the Senate Banking Committee Phil Gramm was largely responsible for the financial deregulation plaguing the economy today, Time says. Gramm played the leading role in reversing the Glass-Steagall Act, which separated commercial banks from Wall Street. Bush may have been to blame for letting deregulation go unchecked, but former President Bill Clinton paved the way for the deregulation policies during his tenure in the White House. Clinton's strokes of "free-wheeling capitalism," Time reports, are what landed him on the list.

Bush may have been to blame for letting deregulation go unchecked, but former President Bill Clinton paved the way for the deregulation policies during his tenure in the White House. Clinton's strokes of "free-wheeling capitalism," Time reports, are what landed him on the list. The Federal Reserve may be at fault. When it cut interest rates after the dot-com bubble, credit became cheap.

The Federal Reserve may be at fault. When it cut interest rates after the dot-com bubble, credit became cheap. How about blaming Wall Street firms themselves? They didn't pay enough attention to their risky loans.

How about blaming Wall Street firms themselves? They didn't pay enough attention to their risky loans. Bear Stearns CEO Jimmy Cayne was the worst of the worst CEOs, says Time - he regularly took luxurious three-day golf weekends and reportedly smoked pot. Thanks to Cayne, Bear held millions of dollars in worthless bonds and was eventually sold to JP Morgan in an embarrassing deal that put the price of the entire company at less worth than its office building.

Bear Stearns CEO Jimmy Cayne was the worst of the worst CEOs, says Time - he regularly took luxurious three-day golf weekends and reportedly smoked pot. Thanks to Cayne, Bear held millions of dollars in worthless bonds and was eventually sold to JP Morgan in an embarrassing deal that put the price of the entire company at less worth than its office building. Ex-Securities Exchange Commission chief Christopher Cox ignored warnings about Bernie Madoff's schemes and watched the markets crumble with little action for the better part of last year, Time reports.

Ex-Securities Exchange Commission chief Christopher Cox ignored warnings about Bernie Madoff's schemes and watched the markets crumble with little action for the better part of last year, Time reports. Former Treasury Secretary Henry Paulson allowed Lehman Bros. to collapse, began financial recovery too late in the game, and proposed a shaky-at-best bailout bill during his time under President Bush. Under Paulson, the economy continued its descent to recession - and the Secretary failed to stop its slide.

Former Treasury Secretary Henry Paulson allowed Lehman Bros. to collapse, began financial recovery too late in the game, and proposed a shaky-at-best bailout bill during his time under President Bush. Under Paulson, the economy continued its descent to recession - and the Secretary failed to stop its slide. Another culprit could be real estate agents, who make higher commission by selling higher-priced homes...to people who can't necessarily afford them.

Another culprit could be real estate agents, who make higher commission by selling higher-priced homes...to people who can't necessarily afford them. Do you own a home, and did you buy it with easy credit? Then you, too, can be blamed. Of course, the mortgage brokers were involved too, offering sub prime, adjustable rates that went from low to sky-high.

Do you own a home, and did you buy it with easy credit? Then you, too, can be blamed. Of course, the mortgage brokers were involved too, offering sub prime, adjustable rates that went from low to sky-high. You, the consumers, are also to blame. In 2008, Americans began saving money rather than spending it, Time reports. Prior to that, consumers created a delusion that the age of prosperity would never end.

You, the consumers, are also to blame. In 2008, Americans began saving money rather than spending it, Time reports. Prior to that, consumers created a delusion that the age of prosperity would never end.