What is Subprime?

The NY Daily News reports:

The growing wave of foreclosures casting a shadow over the nation's economy just crashed over 63-year-old Eva Murphy of Queens.

The former airport worker says she became a homeowner after a representative of a company called 2000 Homes showed up on her doorstep in December 2005.

The sales rep told her she could afford to buy a house even though she had bad credit and lived on an amalgam of government subsidies.

The 2000 Homes sales rep promised Murphy a house with a mortgage she could afford. She says he suggested a two-family home on Roscoe St. in Jamaica, Queens, for $430,000.

After the closing, she discovered the price was actually $538,000.

Murphy says she was told monthly payments would be about $2,000. She later learned they would be $3,990.

She also learned that even though she has no full-time job, her mortgage application listed her as a $9,000-a-month "marketing manager" for a company owned by her loan officer's husband.

Ten months ago, her house ended up in foreclosure.

"It's a mess," she said.

Murphy's mess is increasingly common among vulnerable low-income borrowers, facilitated by questionable brokers like 2000 Homes, a Daily News investigation has found.

Last month, a survey by state Sen. Jeffrey Klein (D-Bronx) showed foreclosures "rising at an alarming rate" in the city as part of the nationwide subprime mortgage crisis.

Klein's survey found 14,561 foreclosures in the city, with nearly 6,000 in Queens, in the 13 months between July 1, 2006, and last July 31.

Most foreclosures involved subprime borrowers like Murphy, would-be homeowners with low credit ratings who did not qualify for conventional mortgages with lower interest rates.

That risky kind of customer is right up 2000 Homes' alley.

With an office in Queens Village and 20 licensed brokers, 2000 Homes has been fined $3,900 for violating regulations aimed at curbing aggressive sales tactics, officials say.

Next month, the company faces a hearing and possible loss of its real estate broker's license in the 2005 sale of a home in St. Albans, Queens, records show.

In that case, 2000 Homes, which was representing the seller, allegedly didn't disclose that one of its brokers was a principal in the company buying the home - as required by law. The buyers flipped the house five months later at a $160,000 profit.

The News also found two other borrowers who alleged that 2000 Homes brokers inflated income on their loan applications.

One was Darlene Smith, who settled a suit accusing 2000 Homes of exaggerating her and her niece's incomes to back up a subprime mortgage on their $259,000 house in Far Rockaway in 2005.

In Murphy's case, 2000 Homes showed up in December 2005. At the time, Murphy says, she was fighting with a landlord she says wanted to evict her.

A month later, 2000 Homes broker Jacob Atzmon told her she had bad credit - but he could help. She just had to cough up $2,250.

She said she borrowed the money from a friend. A handwritten note signed by Atzmon and dated Jan. 25, 2006, states, "I get $2,250 from Miss Eva Murphy for work on her credit report."

Four months later, Murphy went to 2000 Homes to sign papers. When she pointed out that the papers had not been filled out, she was told not to worry about it.

When she later learned what was put in those blanks, she couldn't believe what she saw.

Murphy says she gets $788 a month from Social Security and Workmen's Compensation, $260 a month in welfare benefits and some extra cash collecting cans.

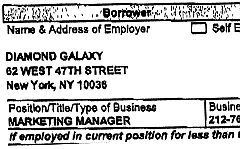

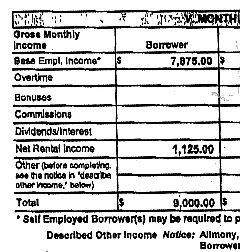

On one of the mortgage applications, which she says was filled out by a 2000 Homes-affiliated employee, Murphy was listed as a $9,000-a-month "marketing manager" for a Diamond District jeweler. On another, she's listed making $7,875 a month at the same job.

This was news to Murphy.

"I haven't worked since Jan. 29, 1991, and now all of sudden I got a job in the diamond industry," said Murphy. "I'm supposed to be a manager or something. Oh, my God. How did they do that?"

One of Murphy's loan applications was signed by Tikva Davaran, who told The News she was a loan officer at Metro Elite Mortgage Corp., which regularly works in concert with 2000 Homes.

Davaran said she or one of her assistants filled out the application after interviewing Murphy. As it happened, Diamond Galaxy, listed as Murphy's alleged "employer" on her mortgage application, was owned by Davaran's husband, Shahriar.

The Davarans claim Murphy briefly worked for Diamond Galaxy. Shahriar Davaran said Murphy "was supposed to do advertising on a computer for us."

"I do not even know how to use a computer," Murphy countered. "I don't even know the man."

Tikva Davaran could not explain why one application lists Murphy's salary as $9,000 a month but another lists it at $7,875.

"I honestly don't recall what happened," Davaran said.

Murphy said she was in a rush at the May 26, 2006 closing because her girlfriend's daughter had been hit by a car.

"I'm trying to hurry out of this closing and they said, 'Wait, wait, wait,'" Murphy said. "I said, No, 'I got to go. ... I'm just signing these papers to get out.'"

She signed for two loans: a $430,400 adjustable rate mortgage starting with a 7.3% interest rate that would reset in 2008, and a $107,600 mortgage repayable in 15 years with a final $91,735.13 balloon payment and an 11.3% interest rate.

She borrowed $5,000 for the down payment.

Subprime loans are mortgages written for people with poor credit. Many are so-called exotic loans, including interest-only mortgages, or ones with low front-end rates that adjust later. Subprime mortgages peaked during the recent housing boom, when lenders relaxed credit requirements for borrowers. Some economists fear that large numbers of subprime borrowers could default on their mortgages, either because rates adjust higher or simply because they were poor risks to begin with.

Murphy said 2000 Homes provided her with a lawyer, Jason Oshins, but at the closing, another lawyer, Dean Mavrides, showed up.

A breakdown of Murphy's closing costs shows each lawyer got $750 for the closing, with another $13,182 listed simply as "Oshins, as atty."

Oshins told The News, "I could not answer any of your questions under the scope of privilege."

Mavrides did not return a call.

Eitan Sror, chairman of 2000 Homes, provided a copy of the sales contract, which was dated May 4, 2006, and signed by Murphy, showing the price of the house was $538,000.

"I can't see how she would think otherwise," he said.

Sror said he didn't know about Murphy's loan documents, adding, "We're not required to keep any information that has to do with the mortgage." He denied the company's brokers encouraged the other two accusers to exaggerate incomes.

Murphy says she doesn't know what she'll do if she loses the house.

"I didn't know there was so many dishonest people that they can just sell you a bunch of garbage," she said. "And this is what this is - a bunch of garbage."

skip to main |

skip to sidebar

Reference materials' site for The Constant American.

Latest From CNN

Must Reading

- Life Inc.: How The World Became a Corporation and How To Take It Back by Douglas Rushkoff

- The Dark Side: The Inside Story of How The War on Terror Turned into a War on American Ideals by Jane Mayer

- Torture Team: Rumsfeld's Memo and the Betrayal of American Values by Philippe Sands

- Class 11: Inside the CIA's First Post-9/11 Spy Class by T.J. Waters

- The Terror Dream: Fear and Fantasy in Post-9/11 American by Susan Faludi

- The Shock Doctrine: The Rise of Disaster Capitalism by Naomi Klein

- A Pretext for War: 9/11, Iraq, and the Abuse of America's Intelligence Agencies by James Bamford

- The Italian Letter: How the Bush Administration Used a Fake Letter to Build the Case for War in Iraq by Peter Eisner

- Blue Covenant: The Global Water Crisis and the Coming Battle for the Right to Water by Maude Barlow

- The One Percent Doctrine by Ron Suskind

- Nemesis: The Last Days of the American Republic (American Empire Project) by Chalmers Johnson

- Free Lunch: How the Weathiest Americans Enrich Themselves at Government Expense (and Stick You with the Bill) by David Cay Johnston

- You Have No Rights: Stories of America in an Age of Repression by Matthew Rothschild

- What We Say Goes: Conversations on U.S. Power in a Changing World by Noam Chomsky, David Barsamian

- Blink: The Power of Thinking Without Thinking by Malcolm Gladwell

- Blackwater: The Rise of the World's Most Powerful Mercenary Army by Jeremy Scahill

- Whose Freedom?: The Battle Over America's Most Important Idea by George Lakoff

- Blue Gold: The Fight to Stop the Corporate Theft of the World's Water by Maude Barlow and Tony Clarke

- Don't Think of an Elephant: Know Your Values and Frame the Debate--The Essential Guide for Progressives by George Lakoff

- Perfectly Legal: The Covert Campaign to Rig Our Tax System to Benefit the Super Rich--and Cheat Everybody Else by David Cay Johnston

- The Tipping Point: How Little Things Can Make a Big Difference by Malcolm Gladwell

- Unequal Protection: The Rise of Corporate Dominance and the Theft of Human Rights by Thom Hartmann

- Secrecy & Privilege | Neck Deep

- The Unwanted Gaze: The Destruction of Privacy in America by Jeffrey Rosen

- The October Surprise Mystery

- The Seven Sisters: The great oil companies & the world they shaped

- People's History of the United States by Howard Zinn

- The Student As Nigger by Jerry Farber

Bright Ideas

********************************

Energy Generating Dance Floor

******************************** Stop Junk Mail

********************************

C O N T R I B U T O R S

- Maeven

Blogs on Military Intelligence

Iraq & Afghanistan

Reference Sites

Reference Files

Document File

- [alternative address]

- Analysis-How to train death squads and quash revolutions from San Salvador to Iraq

- Foreclosed: State of the Dream 2008

- Memorandum: Construction Workers Camp at the New Embassy Compound, Baghdad

- OLC Torture Memo-May 10, 2005 (20 pages)

- OLC Torture Memo-May 10, 2005 (46 pages)

- OLC Torture Memo-May 2002

- OLC Torture Memo-May 30, 2005 (40 pages)

- Questions Raised about the Conduct of the State Department Inspector General

- The First Report of the Congressional Oversight Panel for Economic Stabilization

- U.S. Army memo: Collecting Information on U.S. Persons

- U.S. Army: Civilian Inmate Prison Camps on Army Installations

- U.S. CounterInsurgency Manual

- U.S. CounterInsurgency Manual-1994 Version

- U.S. Special Forces CounterInsurgency Manuel - WikiLeaks

Climate Change

What"s Up In The Universe?

Let's Go To The Movies!

[+/-] expand/collapse

Life Inc., The Movie

James Burke's After The Warming

Israel And Palestine After Disengagement: "Where Do We Go From Here?"

Harvard University 11/29/05

Part 1 of 7 Noam Chomsky vs Alan Dershowitz

Israel And Palestine After Disengagement: "Where Do We Go From Here?"

Harvard University 11/29/05

Part 2 of 7 Noam Chomsky vs Alan Dershowitz

Israel And Palestine After Disengagement: "Where Do We Go From Here?"

Harvard University 11/29/05

Part 3 of 7 Noam Chomsky vs Alan Dershowitz

Israel And Palestine After Disengagement: "Where Do We Go From Here?"

Harvard University 11/29/05

Part 4 of 7 Noam Chomsky vs Alan Dershowitz

Israel And Palestine After Disengagement: "Where Do We Go From Here?"

Harvard University 11/29/05

Part 5 of 7 Noam Chomsky vs Alan Dershowitz

Israel And Palestine After Disengagement: "Where Do We Go From Here?"

Harvard University 11/29/05

Part 6 of 7 Noam Chomsky vs Alan Dershowitz

Israel And Palestine After Disengagement: "Where Do We Go From Here?"

Harvard University 11/29/05

Part 7 of 7 "Distorted Morality," a lecture by Noam Chomsky: Noam Chomsky on BookTV, 4/17/07, Part 1: Noam Chomsky on BookTV, 4/17/07, Part 2: Noam Chomsky at MIT, "The Militarization of Science and Space": Noam Chomsky's "Manufacturing Consent": 9/11 Truth: Unusual Evacuations

* * * * * * *

Torturing Democracy* * * * * * *

Peace, Propaganda and the Promised Land The Revolution Will Not Be Televised - The Smartest Guys in the RoomEnron

Posted Jun 08, 2006Full Version

Iraq's Missing Billions War Made Easy The Big Buy - The Rise and Fall of Tom Delay Iraq: The Hidden Story Iraq For Sale - a Robert Greenwald film The Secret Government - PBS, Bill Moyers The History of Oil - Robert Newman The Power of Nightmares "Confessions of an Economic Hitman," an interview with the author, John Perkins: "America: Freedom to Fascism," a film by Aaron Russo: Greg Palast, "How Bush Stole The 2000 Election," Part 1 of 2: Sir, No Sir! Greg Palast, "How Bush Stole The 2000 Election," Part 2 of 2: Noam Chomsky vs Alan DershowitzIsrael And Palestine After Disengagement: "Where Do We Go From Here?"

Harvard University 11/29/05

Part 1 of 7 Noam Chomsky vs Alan Dershowitz

Israel And Palestine After Disengagement: "Where Do We Go From Here?"

Harvard University 11/29/05

Part 2 of 7 Noam Chomsky vs Alan Dershowitz

Israel And Palestine After Disengagement: "Where Do We Go From Here?"

Harvard University 11/29/05

Part 3 of 7 Noam Chomsky vs Alan Dershowitz

Israel And Palestine After Disengagement: "Where Do We Go From Here?"

Harvard University 11/29/05

Part 4 of 7 Noam Chomsky vs Alan Dershowitz

Israel And Palestine After Disengagement: "Where Do We Go From Here?"

Harvard University 11/29/05

Part 5 of 7 Noam Chomsky vs Alan Dershowitz

Israel And Palestine After Disengagement: "Where Do We Go From Here?"

Harvard University 11/29/05

Part 6 of 7 Noam Chomsky vs Alan Dershowitz

Israel And Palestine After Disengagement: "Where Do We Go From Here?"

Harvard University 11/29/05

Part 7 of 7 "Distorted Morality," a lecture by Noam Chomsky: Noam Chomsky on BookTV, 4/17/07, Part 1: Noam Chomsky on BookTV, 4/17/07, Part 2: Noam Chomsky at MIT, "The Militarization of Science and Space": Noam Chomsky's "Manufacturing Consent": 9/11 Truth: Unusual Evacuations

ExperiLabels [+/-]

- 10th U.S. Circuit Court of Appeals (1)

- 110th Congress (1)

- 1949 Geneva Conventions (4)

- 1949 Geneva Conventions-Fourth (1)

- 1949 Geneva Conventions-Third (1)

- 501 (c) (4) (1)

- 60 Minutes (1)

- 7th U.S. Circuit Court of Appeals (1)

- 9/11/01 (34)

- 9th U.S. Circuit Court of Appeals (2)

- Aaron Mate (1)

- Abd al-Rahim al-Nahsiri (1)

- Abdul-Mahdi (1)

- abortion (10)

- Abu Dhabi (1)

- Abu Ghraib (19)

- Abu Zubaydah (2)

- ACLU (3)

- activism (3)

- acts of misdirection? (3)

- Admiral Michael Mullen (1)

- advisory Board (1)

- Afghan civilians (1)

- Afghanistan (10)

- Ahmed Chalabi (1)

- Al Gore (4)

- Al Kamen (1)

- Al Qaeda (16)

- Al Sharpton (4)

- al-Hashemi (2)

- al-Mahdi (1)

- al-Maliki (11)

- al-Sistani (1)

- Alabama (3)

- Alan Greenspan (1)

- Alan Mollohan (1)

- Alan Simpson (1)

- Alaska (10)

- Alberto Gonzales (26)

- Alberto Mora (1)

- Alfa Group (1)

- Alphonse D'Amato (1)

- alternative media (1)

- amendment 2073 (1)

- American culture (49)

- American Petroleum Institute (1)

- Amy Goodman (7)

- An Inconvenient Truth (1)

- Analysis Corp (1)

- Anbar (3)

- Andrea Mitchell (1)

- Andrew Card (5)

- animals (15)

- Another Bush cock-up (4)

- Anthony Cordesman (1)

- Anthony Kennedy (1)

- Anthony Zinni (1)

- anthrax (6)

- antiquities (1)

- Antonia Juhasz (2)

- AQI (1)

- Arent Fox Kintner Plotkin and Kahn (1)

- Ari Fleischer (1)

- Arizona (3)

- Arkansas (1)

- Arlen Specter (14)

- arms sales (3)

- Armstrong Williams (3)

- Arnold Schwarzenegger (1)

- art (3)

- asbestos (2)

- Atlanta (1)

- audio (2)

- AUMF 2002 (1)

- Australia (1)

- Bab al-Sheik (1)

- Baghdad (1)

- Bagram (1)

- bailout (4)

- Bakhtawar Zardari (1)

- Bangladesh (1)

- Baqouba (1)

- Barack Obama (43)

- Barbara Bush (5)

- Barry Jackson (1)

- Basra (2)

- BCCI (2)

- Bearing Point (1)

- bees (2)

- Ben Bernanke (1)

- Ben Nelson (2)

- Benazir Bhutto (7)

- benchmarks (3)

- Benita Fitzgerald Mosley (2)

- Benjamin Netanyahu (1)

- Big Agra (7)

- Big Business (2)

- Big Oil (12)

- Big Pharma (1)

- BigAgra (1)

- Bilawal Bhutto (2)

- Bill Clinton (19)

- Bill Clinton was no friend to liberals (1)

- Bill Gates (1)

- Bill Keller (1)

- Bill Kristol (2)

- Bill Maher (1)

- Bill Moyers (2)

- Bill Richardson (3)

- Bill Sammon (2)

- birds (1)

- Blackstone (2)

- Blackwater (11)

- blogging (4)

- Bob Baer (2)

- Bob Corker (1)

- Bob Graham (1)

- Bob Perry (1)

- Bob Shrum (1)

- Bobby Jindal (2)

- Bolivia (1)

- books (30)

- boys will be boys (1)

- BP (4)

- BP America (1)

- BP PLC (1)

- Brad Delong (1)

- Bradley Schlozman (1)

- Brazil (1)

- Bremer's 100 Orders (2)

- Brent Scowcroft (3)

- Brewster Jennings (1)

- Brian Schweitzer (1)

- Brigadier General Janis Karpinski (3)

- Bruce Bartlett (1)

- Bruce Fein (1)

- Bruce McMahan (2)

- Bud Cummins (1)

- Bulgaria (1)

- Bureau of Diplomatic Security (1)

- Burma (3)

- Bush (89)

- Bush 1 administration (2)

- Bush administration (98)

- Bush family (2)

- Bush veto (4)

- Bush-speak (1)

- Bush's legacy (5)

- Bush's surge (38)

- CAFTA (1)

- California (20)

- Cambodia (1)

- Camp Bucca (2)

- Camp Cropper (1)

- campaign contributors (1)

- Canada (1)

- cancer (1)

- candidates' positions (1)

- capitalism (3)

- Carl Levin (4)

- Carl Lindner (1)

- Carlyle Group (3)

- Carol Lam (1)

- Caroline Cheeks Kilpatrick (1)

- CBO (1)

- CBS (3)

- celebrity gossip (2)

- censorship (3)

- Centers for Disease Control (1)

- Chad (1)

- Chalmers Johnson (1)

- Charles Duelfer (2)

- Charles Grassley (6)

- Charles Koch (2)

- Charlie Rangel (1)

- charts (1)

- Chechnya (1)

- chemical industry (1)

- Chevron (3)

- ChevronTexaco (1)

- Chicago (2)

- children (1)

- China (12)

- Chip Reid (1)

- Chris Dodd (4)

- Chris Hedges (1)

- Chris Matthews (10)

- Chris Van Hollen (2)

- Christian Coalition (1)

- Christine Todd Whitman (3)

- Christopher Hitchens (1)

- Chuck Schumer (9)

- CIA (36)

- CIA leak investigation (4)

- CIA tapes (1)

- Cindy Sheehan (3)

- Citibank (1)

- civil liberties (4)

- civil rights (5)

- Claire McCaskill (1)

- Clarence Page (2)

- Clarence Thomas (1)

- Cleveland (1)

- climate change (8)

- Clinton administration (2)

- cluster bombs (3)

- CNN (1)

- coal (2)

- Coalition Provisional Authority (4)

- Cofer Black (2)

- Cold War (2)

- Colin Powell (5)

- Colleen Rowley (3)

- Colombia (1)

- Colonel Thomas M. Pappas (3)

- Colorado (3)

- Condoleeza Rice (5)

- Congo (1)

- Congressional Record (1)

- Connecticut (1)

- Conoco (1)

- ConocoPhillips (1)

- Conservatives (5)

- conspicuous consumption (12)

- Contempt of Congress (2)

- contractors (17)

- corn (5)

- corporate welfare (1)

- corruption (27)

- Council for National Policy (4)

- Council on Foreign Relations (1)

- CPA (9)

- Craig Crawford (2)

- Craig Fuller (1)

- Craig Thomas (1)

- crumbling infrastructure (1)

- Cuba (11)

- culture (22)

- Curveball (1)

- Cynthia Tucker (1)

- Cyril Wecht (1)

- Czech Republic (1)

- D and E/D and X/Partial Birth Abortion (2)

- D.C. voting rights (1)

- Dan Abrams (1)

- Dan Bartlett (2)

- Dan Burton (1)

- Dan Metcalfe (1)

- Dan Rather (1)

- Daniel Ellsberg (2)

- Daniel Inouye (1)

- Darrell Issa (2)

- David Addington (1)

- David Albright (2)

- David Broder (1)

- David Brooks (1)

- David Frum (1)

- David Gergen (2)

- David Gregory (8)

- David Gribben (1)

- David Horgan (1)

- David Kay (1)

- David Koch (2)

- David M. McIntosh (1)

- David MacMichael (2)

- David Rivkin (1)

- David Shuster (1)

- David Vitter (6)

- death penalty (2)

- death toll (1)

- debates (5)

- Debra Wong Yang (1)

- Defense Appropriations Subcommittee (1)

- Defense Authoriation Act of 2006 (1)

- Defense Policy Board (1)

- Deforest Soaries (3)

- Democracy Now (11)

- Democratic Party (4)

- Democratic Presidential debates (2)

- Democrats (9)

- Democrats suck too (39)

- Denmark (2)

- Dennis Kucinich (3)

- Department of Homeland Security (3)

- deregulation (17)

- derivatives (1)

- Det Norske Oljeselskap (1)

- detainees (2)

- Detroit (2)

- Diane Beaver (1)

- Dianne Feinstein (7)

- Dick Cheney (37)

- Dick Cheney's energy task force (4)

- Dick Durbin (4)

- Dick Lugar (2)

- dirty tricks (17)

- dissent (1)

- Diyala (1)

- DLC politics (1)

- DNO (2)

- documents (1)

- DoD (1)

- dogs (2)

- DOJ (5)

- domestic spying (1)

- Don Evans (4)

- Don Imus (6)

- Don Siegelman (1)

- Donald Rumsfeld (12)

- Douglas Brinkley (1)

- Douglas Feith (4)

- Dr. Justin Frank (1)

- draft (2)

- Drew Westen (1)

- drought (2)

- drug bill (1)

- drugs-illicit (4)

- drugs-pharmaceutical (1)

- Duncan Hunter (1)

- E.J. Dionne (1)

- earmarks (4)

- Ebay (1)

- economics (23)

- economy (81)

- Ecuador (1)

- Ed Markey (1)

- Ed Rogers (1)

- education (5)

- Egypt (2)

- Ehud Olmert (1)

- El Salvador (2)

- election 1980 (1)

- election 1992 (1)

- election 2000 (8)

- election 2002 (1)

- election 2008 (45)

- election reform (4)

- elections 2002 (2)

- elections 2004 (1)

- elections 2006 (4)

- elections 2008 (76)

- elections 2012 (1)

- electionws 2004 (1)

- Elian Gonzalez (1)

- Elijah Cummings (1)

- Elizabeth Dole (1)

- Ellen Tauscher (1)

- Elliot Abrams (1)

- email (4)

- ENDGAME (1)

- endorsements (3)

- energy (13)

- energy nuclear (2)

- energy nuclear (1)

- energy policy (6)

- entertainment (7)

- environment (59)

- environmental (1)

- EPA (3)

- Eric Edelman (1)

- Eric Holder (1)

- Eric Prince (2)

- Estonia (1)

- ethanol (1)

- ethics (2)

- Eugene Robinson (2)

- European Union (1)

- executive order 12334 (1)

- executive order 12472 (1)

- executive order 12656 (1)

- executive order 12958 (1)

- executive order 13228 (1)

- executive order 13233 (2)

- executive order 13303 (1)

- executive order 13315 (1)

- executive order 13350 (1)

- executive orders (8)

- Executive Privilege (4)

- Exxon (1)

- ExxonMobil (5)

- Fairness Doctrine (1)

- faith-based organizations (2)

- Fallujah (2)

- Fannie Mae and Freddie Mac (1)

- Farm Bill (5)

- Faye Williams (1)

- FBI (16)

- FCC (2)

- FDA (6)

- FDIC (1)

- FEC (1)

- Federal Reserve (4)

- Federalist Society (1)

- FEMA (1)

- filibuster (1)

- financial disclosure (1)

- first amendment (11)

- FISA bill (13)

- fish (3)

- flat tax (1)

- FOIA (1)

- food (46)

- For the children (2)

- For the common good (2)

- Foreign Intelligence cronyism (1)

- fourth amendment (1)

- Fox News (1)

- France (2)

- Frances Townsend (2)

- Frank Murkowski (1)

- Frank Rich (1)

- Frank Riggs (1)

- Fred Fielding (2)

- Fred Koch (1)

- Fred Thompson (15)

- free speech (3)

- free trade (1)

- freedom and democracy in Iraq (6)

- Freedom of Information Act of 2007 (1)

- Freedom to dissent...NOT (1)

- Freedom's Watch (2)

- Frontline (1)

- FUBAR (7)

- Futile Care Law (1)

- Gail Norton (2)

- GAO (7)

- gay rights (3)

- Gaza (2)

- Gazprom (1)

- gender inequality (4)

- Genel Enerji (1)

- General David Petraeus (6)

- General Electric (1)

- General Eric Shenseki (1)

- General Michael Hayden (6)

- General Tommy Franks (1)

- George H.W. Bush (10)

- George Lakoff (1)

- George P. Bush (1)

- George Tenet (15)

- George Voinovich (1)

- Georgia (7)

- Georgia Maryland (1)

- Georgia Pacific Corp. (1)

- Georgia Thompson (1)

- Germany (4)

- Getting To Know Your Adversary (1)

- Glass-Steagall Act of 1933 (1)

- Glenn Greenwald (1)

- global warming (20)

- globalization (2)

- GMO (2)

- Gonzales vs. Carhart (1)

- GOP (12)

- Gordon Brown (2)

- Governor Jim Doyle (1)

- Great Britain (22)

- Greg Thielmann (1)

- Grover Norquist (3)

- Guantanamo (20)

- Guatemala (1)

- Gulf of Mexico (2)

- Gulf War 1 (3)

- guns (2)

- H.R. 1255 (1)

- H.R. 1591 (1)

- H.R. 2206 (1)

- H.R. 3222 (1)

- H.R. 4156 (1)

- H.R. 4241 (1)

- Hague Regulations of 1907 (3)

- Haiti (1)

- Haley Barbour (1)

- Halliburton (6)

- Hamid Karzai (1)

- Hardball (16)

- Harold Ford Jr. (1)

- Harold Ickes (1)

- Harold Simmons (1)

- Harriet Miers (4)

- Harry Reid (9)

- Hatch Act (1)

- Hawaii (1)

- health (65)

- health care reform (1)

- health insurance (6)

- hearings (1)

- hedge fund managers (2)

- hedge funds (2)

- Helms-Burton Act (1)

- Henry Kissinger (1)

- Henry Paulson (3)

- Henry Waxman (8)

- Hezbollah (1)

- Hillary Clinton (62)

- holidays (2)

- homeland security (2)

- Homeland Security appropriations bill (1)

- House Appropriations Committee (3)

- House Committee on Intelligence (3)

- House Committee on Oversight and Government Reform (6)

- House Foreign Affairs Committee (1)

- House Judiciary Committee (5)

- House Natural Resources Committee (1)

- House Republicans (6)

- housing (1)

- Howard Fineman (3)

- Howard Wolfson (1)

- HR 1955 (1)

- HSPD 20 (2)

- Huffington Post (1)

- Hugo Chavez (2)

- human rights (13)

- Hungary (1)

- Hurricane Katrina (2)

- Hypocrisy 101 (4)

- Idaho (1)

- Ideas Whose Time Has Come? (1)

- illegal immigration (7)

- Illinois (3)

- IMF (4)

- impeachment (12)

- implosions (10)

- In our names (19)

- India (1)

- Indiana (4)

- Indonesia (1)

- insurgency (1)

- intelligence (9)

- Internet (7)

- interviews (19)

- Invocon (1)

- Iowa (3)

- IPO (1)

- Iran (27)

- Iran-Contra (1)

- Iran-Iraq war (1)

- Iraq (42)

- Iraq czar (1)

- Iraq elections (2)

- Iraq Health Ministry (1)

- Iraq occupation (2)

- Iraq Petroleum Company (1)

- Iraq reconstruction (5)

- Iraq Study Group (1)

- Iraq Survey Group (2)

- Iraqi army (1)

- Iraqi civilians (13)

- Iraqi Islamic Party (1)

- Ireland (1)

- Ishaqi (1)

- Islam (1)

- Israel (18)

- Issam Al-Chalabi (1)

- Italy (1)

- Iyad Allawi (1)

- Jack Abramoff (1)

- Jack Reed (2)

- James Baker (2)

- James Carville (3)

- James Comey (6)

- James Dobson (1)

- James Inholfe (1)

- James K. Haveman (1)

- James Schlesinger (1)

- James Sensenbrenner (1)

- James Woolsey (3)

- James Yousef Yee (1)

- Jan Schakowsky (1)

- Jane Dalton (1)

- Jane Harman (3)

- Japan (2)

- Jay Dardenne (1)

- Jay Leno (1)

- Jay Rockefeller (6)

- Jean Shaheen (4)

- Jean-Baptiste Aristide (1)

- Jean-Bertrand Aristide (1)

- Jeff Sessions (3)

- Jeffrey Toobin (1)

- Jennifer Fitzgerald (1)

- Jeremy Scahill (3)

- Jerrold Nadler (2)

- Jerry Lewis (1)

- Jesse Helms (1)

- Jesse Jackson (1)

- Jill Abramson (1)

- Jim Bunning (1)

- Jim DeMint (2)

- Jim Donelon (1)

- Jim Gilmore (1)

- Jim Hightower (2)

- Jim Marcinkowski (1)

- Jim McCrery (1)

- Jim McGovern (1)

- Jim Miklaszewski (1)

- Jim Moran (1)

- Jim O'Beirne (2)

- Jim Rogers (3)

- Jim VandeHei (1)

- Jim Webb (2)

- Jimmy Breslin (1)

- Jimmy Carter (1)

- Jo Ann Emerson (1)

- Joan Baez (1)

- Joe Allbaugh (1)

- Joe Biden (4)

- Joe Conason (3)

- Joe DiGenova (2)

- Joe Klein (1)

- Joe Lieberman (5)

- Joe Scarborough (1)

- Joe Wilson (9)

- John Ashcroft (7)

- John B. Taylor (1)

- John Barrasso (1)

- John Boehner (3)

- John Bolton (1)

- John Conyers (5)

- John Cornyn (1)

- John D. Bates (1)

- John Danforth (1)

- John Dean (2)

- John Dingell (2)

- John Edwards (9)

- John Gilmore (2)

- John Harris (2)

- John Harwood (2)

- John Kerry (3)

- John King (1)

- John McCain (11)

- John Mellencamp (1)

- John Murtha (3)

- John Nichols (2)

- John Roberts (4)

- John Sununu (3)

- John Warner (4)

- John Yoo (1)

- John Zogby (1)

- Joint Chiefs of Staff (2)

- Jon Corzine (1)

- Jonathan Alter (2)

- Jonathan Cohn (1)

- Jonathan Turley (1)

- Jordan (4)

- Jose Padilla (1)

- Joseph Stiglitz (1)

- Josh Bolten (2)

- Judith Miller (2)

- Judith Nathan Giuliani (1)

- K Street (2)

- Kamil Mubdir Gailani (1)

- Karbala (1)

- Karen Hughes (1)

- Karl Rove (25)

- Kate O'Beirne (2)

- Kazakhstan (1)

- Keith Olbermann (6)

- Ken Blackwell (1)

- Ken Mehlman (1)

- Ken Pollack (1)

- Ken Salazar (1)

- Ken Starr (1)

- Ken Wainstein (1)

- Kennedy family (1)

- Kenneth Blackwell (1)

- Kentucky (1)

- Ketchum (1)

- Khalid Sheik Mohammed (1)

- King Abdullah (1)

- Kit Bond (2)

- Kitty Kelley (1)

- knuckle-dragging Americans (1)

- Koch brothers (2)

- Koch Industries (1)

- KRG (1)

- Kristin Breitweiser (1)

- Kurdistan (3)

- Kurdistan Regional Government (2)

- Kurds (7)

- Kyle Sampson (1)

- L-1 Identity Solutions (1)

- Lamar Alexander (2)

- Lancet study (9)

- Lanny Griffith (1)

- Larry Craig (2)

- Larry Ellison (1)

- Larry Johnson (2)

- Larry Lindsey (1)

- Larry Summers (1)

- Larry Wilkerson (1)

- Las Vegas (3)

- Latvia (1)

- Laura Bush (1)

- Laurie David (1)

- Lawrence Korb (1)

- Leandro Aragoncillo (1)

- Lebanon (3)

- Lee Hamilton (1)

- legislation (30)

- Leon Panetta (1)

- Liberals (2)

- Libya (4)

- Lieutenant General Ricardo S. Sanchez (1)

- Lindsay Graham (6)

- Lisa Murkowski (1)

- lobbyists (6)

- Lockerbie (3)

- Lois Romano (1)

- London (1)

- long war (1)

- Loretta Sanchez (1)

- Lou Dubose (1)

- Louisiana (7)

- Lt. Colonel Steven Jordan (2)

- Lt. General Douglas Lute (2)

- Lt. General Martin Dempsey (1)

- Lt. General Ricardo Sanchez (1)

- Lukoil (1)

- Lynndie England (1)

- Madrid bombings (1)

- Mahdi Army (1)

- Mahmoom Khaghani (1)

- Maine (3)

- mainstream media (8)

- Major General Antonio Taguba (1)

- Major General Benjamin R. Mixon (1)

- Major General Geoffrey Miller (11)

- maps (1)

- Margaret Carlson (1)

- Marion Spike Bowman (2)

- Mark Corallo (1)

- Mark McKinnon (1)

- Mark Mix (1)

- Mark Penn (2)

- Mark Pryor (1)

- martial law (1)

- Mary Beth Buchanan (3)

- Mary Cheney (1)

- Mary Landrieu (1)

- Mary Matalin (2)

- Maryland (2)

- Massachusetts (2)

- Matt Brooks (1)

- Matt Cooper (1)

- Matthew Mead (1)

- Maury Wills (1)

- Max Baucus (1)

- media (15)

- Medicaid (1)

- medical ethics (1)

- Meet the Press (4)

- Meghan O'Sullivan (1)

- Mel Sembler (1)

- meltdown (16)

- men (1)

- mental health (11)

- mental illness (6)

- Mexico (4)

- Michael Allan Leach (1)

- Michael Bloomberg (1)

- Michael Chertoff (6)

- Michael Eric Dyson (1)

- Michael Garcia (1)

- Michael Ledeen (1)

- Michael Moore (4)

- Michael Mukasey (13)

- Michael O'Hanlon (2)

- Michael Pollan (7)

- Michael R. Gordon (2)

- Michael Scheuer (2)

- Michael Steele (1)

- Michael Turk (1)

- Michelle Obama (1)

- Michigan (2)

- Mickey Herskowitz (1)

- Middle East (15)

- Mike Barnicle (1)

- Mike Huckabee (9)

- Mike McConnell (3)

- Mike Mullen (1)

- military budget (5)

- Military Commissions Act of 2006 (1)

- military equipment (15)

- Military Industrial Complex (4)

- military tribunals (1)

- Milwaukee (1)

- Minnesota (2)

- Mississippi (2)

- Missouri (1)

- Mitch McConnell (4)

- Mitt Romney (9)

- Molly Ivins (2)

- moments in history (1)

- Monica Goodling (1)

- Monica Lewinsky (1)

- Montana (3)

- Most Ethical Congress (1)

- MoveOn.org (2)

- movies (2)

- MSNBC (3)

- multinational corporations (2)

- Murray Waas (2)

- N. Korea (4)

- NAFTA (3)

- Najaf (1)

- Nancy Pelosi (16)

- Naomi Klein (10)

- Naomi Wolf (1)

- narcissistic personality disorder (1)

- Nat Parry (1)

- National Defense Authorization Act for 2008 (4)

- National Guard (2)

- National Republican Congressional Committee (1)

- National Security (1)

- National Security Archive (2)

- National Security Decision Directive 188 (1)

- Neil Bush (2)

- Nelson Cohen (3)

- Neoconservatives (4)

- Netherlands (1)

- Nevada (1)

- New Afghanistan (3)

- New Hampshire (8)

- New Iraq (51)

- New Jersey (1)

- New Orleans (1)

- New World Order (9)

- New York (7)

- New York Times (5)

- New Yorker (1)

- Newsweek (8)

- Newt Gingrich (2)

- NIE (4)

- NIH (1)

- Ninth Circuit Court of Appeals (2)

- No Child Left Behind (1)

- No WMD (2)

- Noam Chomsky (1)

- Norm Coleman (1)

- North Carolina (3)

- Now That Obama's President - What's Left To Do? (1)

- NRC (1)

- NRCC (1)

- NSA (6)

- NSL (2)

- NSPD 51 (2)

- nuclear (12)

- Obama administration (10)

- obituaries (2)

- oceans (4)

- offshoring (1)

- Ohio (3)

- oil (14)

- oil and gas (20)

- oil law (21)

- Oklahoma (1)

- Oliver North (1)

- Olympia Snowe (1)

- OPEC (3)

- Operation Clean Break (1)

- Operation Rescue (1)

- Oprah Winfrey (1)

- Order 37 (2)

- Order 39 (3)

- Order 40 (1)

- Oregon (1)

- organic farming (1)

- organized labor (7)

- Orrin Hatch (1)

- Osama Bin Laden (9)

- outsourcing (1)

- owls (1)

- PACS (1)

- Pakistan (15)

- Pakistan's People's Party (2)

- Palestinians (2)

- Pan Am 103 (2)

- Paris Hilton (2)

- parliamentary procedure (1)

- passportgate (2)

- Pat Buchanan (4)

- Pat Leahy (2)

- Pat Roberts (4)

- Pat Tillman (2)

- Patrick Lang (1)

- Patrick Leahy (10)

- Patrick McHenry (1)

- Patriot Act (12)

- Patty Murray (1)

- Paul Allen (1)

- Paul Bremer (9)

- Paul Craig Roberts (1)

- Paul Eaton (1)

- Paul Krugman (8)

- Paul O'Neill (1)

- Paul Rieckhoff (2)

- Paul Wellstone (1)

- Paul Weyrich (1)

- Paul Wolfowitz (5)

- PDVSA (1)

- Peak oil (2)

- Pennsylvania (4)

- Pentagon (22)

- people (1)

- Pervez Musharraf (10)

- Pete Domenici (1)

- Peter King (1)

- Petoil (1)

- Petrel Resources (1)

- Phil Gingrey (1)

- Phil Giraldi (1)

- Phil Griffin (1)

- Philip Atkinson (1)

- Philip Zelikow (1)

- Phillipines (2)

- photos (66)

- Phyllis Schlafly (1)

- PKK (1)

- Plan B (1)

- PNAC (1)

- Poland (1)

- police brutality (2)

- political fundraising (1)

- political operatives (1)

- polls (4)

- population control (1)

- Porter Goss (2)

- poverty in America (3)

- Presidential candidates (8)

- Presidential Directives (1)

- Presidential pardons (1)

- Presidential Records Act of 1978 (6)

- press releases (1)

- prewar intelligence (1)

- Prince Bandar bin Sultan (2)

- prisons (6)

- privacy (15)

- Privacy Act of 1974 (1)

- private contractors (1)

- private equity (2)

- privatization (20)

- Profiles (11)

- Project Checkmate (1)

- propaganda (4)

- Protect America Act (2)

- PSA (1)

- psychologists (1)

- Psychology Today (1)

- PTSD (1)

- public relations (1)

- Puerto Rico (2)

- Pulitizer prizes (1)

- Putin (3)

- QinetiQ (1)

- Quds (1)

- race card (7)

- Rachel Maddow (3)

- racism (4)

- Rahm Emanuel (1)

- Ramadi (1)

- Ramzi Yousef (1)

- Rand Corporation (2)

- Ray McGovern (6)

- Reagan administration (1)

- real estate (2)

- Reasons not to vote for Republicans (22)

- Reasons we need campaign finance reform (7)

- recess appointment (1)

- red flags (1)

- reference file (1)

- reference papers (1)

- refugees (3)

- religion (3)

- rendition (2)

- reports (1)

- Republican Party (3)

- Republicans (15)

- Richard Armitage (1)

- Richard Baker (1)

- Richard Clarke (1)

- Richard E. Stickler (1)

- Richard Mellon Scaife (2)

- Richard Nixon (2)

- Richard Perle (6)

- Richard Viguerie (1)

- Richard Wolffe (1)

- Rick Santorum (1)

- right-wing organizations (2)

- RNC (7)

- Robert Dreyfuss (1)

- Robert F. Kennedy Jr. (2)

- Robert Fisk (1)

- Robert Gates (9)

- Robert Johnson (1)

- Robert Kuttner (1)

- Robert Mueller (10)

- Robert Novak (3)

- Robert Parry (6)

- Robert Reich (1)

- Rodney Alexander (1)

- Roger Simon (2)

- Roger Stone (2)

- Romania (1)

- Ron Brownstein (2)

- Ron Paul (3)

- Ron Reagan (1)

- Ron Suskind (1)

- Ron Wyden (1)

- Ronald Reagan (3)

- Roslynn Mauskopf (1)

- Royal Dutch Shell (3)

- Royal Dutch/Shell Group of Cos. (1)

- Rudy Giuliani (5)

- Rudy Guiliani (1)

- rule of law (8)

- Rush Holt (1)

- Russ Feingold (2)

- Russell Feingold (1)

- Russell Simmons (1)

- Russia (4)

- Rwanda (1)

- Ryan Crocker (3)

- S. 1927 (4)

- S. 1932 (1)

- S. 2340 (1)

- S. Carolina (4)

- S. Dakota (1)

- S. Korea (1)

- Sabrina D. Harman (1)

- Saddam Hussein (3)

- Sadr City (1)

- SAIC (1)

- Sam Bodman (1)

- Sam Brownback (2)

- Samarra (2)

- San Francisco (4)

- sanctions (1)

- Sandra Day O'Connor (2)

- Sara Taylor (4)

- Sarah Palin (7)

- Sarkozy (1)

- Saudi Arabia (17)

- Savings and Loan crisis (3)

- science (2)

- Scooter Libby (8)

- Scott Ritter (2)

- SEC (1)

- secrecy (12)

- secret government (2)

- secret holds (1)

- secret prisons (4)

- Secret Service (3)

- secular democracy (1)

- Senate Appropriations subcommittee (2)

- Senate Armed Services Committee (3)

- Senate Energy and Commerce Committee (1)

- Senate Ethics Committee (1)

- Senate Finance Committee (2)

- Senate Intelligence Committee (6)

- Senate Judiciary Committee (22)

- Senate Republicans (1)

- senior issues (2)

- Separation of church and state (8)

- Sergeant Michael J. Smith (1)

- Sergeant Santos A. Cardona (1)

- sex (1)

- sex crimes (1)

- Seymour Hersh (7)

- Sheldon Adelson (2)

- Shell Oil (6)

- Sheryl Crow (1)

- Shiite militias (1)

- shrines (2)

- Sibel Edmonds (1)

- Sibiyha Prince (1)

- Sidney Blumenthal (2)

- SIGIR (1)

- signing statements (1)

- Slovakia (1)

- slow food (2)

- socialism (1)

- SOFA (1)

- Spain (2)

- Special Inspector General for Iraq Reconstruction (1)

- special ops (1)

- Specialist Charles Graner (1)

- speeches (2)

- Stephen Cambone (1)

- Stephen Hadley (8)

- Steve Capus (2)

- Steve Fraser (1)

- Steve McMahon (2)

- Steve Scalise (1)

- Steven Biskupic (1)

- Stuart Bowen (1)

- summer reading list (1)

- Sunni (2)

- sunshine laws (1)

- superdelegates (2)

- supplemental appropriations bill (9)

- Susan Collins (2)

- Susan Page (1)

- Susan Ralston (1)

- Swift Boat veterans (1)

- Swift Boat Veterans for Truth (1)

- Syria (13)

- T. Boone Pickens (1)

- Taguba report (2)

- Talabani (2)

- Taliban (2)

- TALON (1)

- TANG (1)

- taxes (1)

- Ted Kennedy (1)

- Ted Olson (1)

- Ted Stevens (2)

- Telecommunications Act (1)

- Telecoms (2)

- Tennessee (1)

- terrorism (12)

- Terrorist Surveillance Program (6)

- Terry McAuliffe (1)

- Terry O'Donnell (1)

- Texas (11)

- Thailand (1)

- The Fellowship (1)

- think tanks (3)

- Thom Hartmann (1)

- Thomas B. Edsall (1)

- Thomas Blanton (1)

- Thomas Edsall (1)

- Thomas J. Collamore (1)

- Thomas M. Tamm (1)

- Tim Geithner (7)

- Tim Griffin (1)

- Tim LaHaye (1)

- Tim Russert (2)

- Tim Ryan (1)

- Timothy P. Berry (1)

- Todd Graves (1)

- Todd Palin (3)

- Tom Allen (1)

- Tom Andrews (1)

- Tom Brokaw (1)

- Tom Coburn (1)

- Tom Coburt (1)

- Tom Daschle (1)

- Tom Davis (4)

- Tom DeLay (2)

- Tom Harkin (1)

- Tom Lantos (1)

- Tom Maertens (1)

- Tom Oliphant (1)

- Tom Tancredo (1)

- Tom Vilsack (1)

- Tommy Chong (1)

- Tony Blair (7)

- Tony Blankley (2)

- Tony Snow (2)

- tort reform (1)

- torture (51)

- Total (1)

- transcripts (47)

- trauma (2)

- Trent Lott (1)

- trial attorneys (1)

- TSA (1)

- Turkey (4)

- Tyler Drumheller (2)

- Tyumen Oil (1)

- U.S. Air Force (1)

- U.S. Army (2)

- U.S. Army Corps of Engineers (1)

- U.S. Army's Law of Land Warfare (1)

- U.S. Attorney Bill (1)

- U.S. Attorney General (8)

- U.S. Attorneys (23)

- U.S. bases (2)

- U.S. budget (1)

- U.S. Congress (16)

- U.S. Department of Agriculture (5)

- U.S. Department of Homeland Security (13)

- U.S. Department of Justice (3)

- U.S. Department of the Interior (1)

- U.S. Department of Transportation (1)

- U.S. District Court (1)

- U.S. dollar (4)

- U.S. Empire (1)

- U.S. foreign policy (18)

- U.S. House (10)

- U.S. military (62)

- U.S. Senate (13)

- U.S. State Department (6)

- U.S. Supreme Court (3)

- U.S. trade policies (5)

- U.S. Treasury Department (2)

- U.S.A. (1)

- U.S.S.C. (6)

- UAE (2)

- Ukraine (1)

- UN (7)

- UN Human Rights Commission (1)

- UN resolution 1483 (1)

- UN resolution 1546 (1)

- UN Security Council Resolution 687 (1)

- UNCC (1)

- UNICEF (1)

- unitary executive (2)

- Utah (2)

- Vaclav Klaus (1)

- Valerie Jarrett (1)

- Valerie Plame (12)

- Venezuela (2)

- Vermont (1)

- veterans affairs (1)

- VFW (1)

- Vicente Fox (1)

- video (26)

- video links (1)

- videos (21)

- Vince Cannistraro (1)

- Violence in America (1)

- Virginia (6)

- Vivian Stringer (1)

- voter caging (1)

- voter fraud (5)

- voter ID (3)

- Wal-Mart (1)

- Walter Reed Army Medical Center (1)

- war (2)

- war crimes (16)

- war czar (3)

- war in Afghanistan (24)

- war in Iran (19)

- war in Iraq (300)

- war in Vietnam (2)

- war on terror (51)

- war reparations (1)

- warrantless wiretaps (23)

- Warren Buffett (2)

- Washington (1)

- water (12)

- Watergate (1)

- Wayne LaPierre (1)

- wealth disparity (1)

- weapons (2)

- Wendy Cortez (1)

- Western Oilsands (1)

- Westinghouse (1)

- What The Hell Are They Thinking? (1)

- What's the matter with (4)

- Where are the Democrats? (3)

- whistleblowers (2)

- White House Office of Administration (1)

- White House Press Briefing (4)

- Who Broke America? (1)

- Why they hate us (11)

- William Arkin (1)

- William E. Colby (1)

- William J. Haynes (1)

- William Koch (1)

- William Kristol (2)

- William P. Weidner (1)

- William Pryor Jr. (1)

- Wisconsin (2)

- WMD (6)

- Wolf Blitzer (1)

- Wolfeboro (1)

- women (12)

- World Bank (3)

- worthless media (7)

- wounded veterans (2)

- WTO (1)

- Wyoming (1)

- Xe (2)

- Your tax dollars (2)

- YouTube (1)

- Zarqawi (2)

- Zogby (1)

- Zulfikar Ali Bhutto (1)

Labels

- 10th U.S. Circuit Court of Appeals (1)

- 110th Congress (1)

- 1949 Geneva Conventions (4)

- 1949 Geneva Conventions-Fourth (1)

- 1949 Geneva Conventions-Third (1)

- 501 (c) (4) (1)

- 60 Minutes (1)

- 7th U.S. Circuit Court of Appeals (1)

- 9/11/01 (34)

- 9th U.S. Circuit Court of Appeals (2)

- Aaron Mate (1)

- Abd al-Rahim al-Nahsiri (1)

- Abdul-Mahdi (1)

- abortion (10)

- Abu Dhabi (1)

- Abu Ghraib (19)

- Abu Zubaydah (2)

- ACLU (3)

- activism (3)

- acts of misdirection? (3)

- Admiral Michael Mullen (1)

- advisory Board (1)

- Afghan civilians (1)

- Afghanistan (10)

- Ahmed Chalabi (1)

- Al Gore (4)

- Al Kamen (1)

- Al Qaeda (16)

- Al Sharpton (4)

- al-Hashemi (2)

- al-Mahdi (1)

- al-Maliki (11)

- al-Sistani (1)

- Alabama (3)

- Alan Greenspan (1)

- Alan Mollohan (1)

- Alan Simpson (1)

- Alaska (10)

- Alberto Gonzales (26)

- Alberto Mora (1)

- Alfa Group (1)

- Alphonse D'Amato (1)

- alternative media (1)

- amendment 2073 (1)

- American culture (49)

- American Petroleum Institute (1)

- Amy Goodman (7)

- An Inconvenient Truth (1)

- Analysis Corp (1)

- Anbar (3)

- Andrea Mitchell (1)

- Andrew Card (5)

- animals (15)

- Another Bush cock-up (4)

- Anthony Cordesman (1)

- Anthony Kennedy (1)

- Anthony Zinni (1)

- anthrax (6)

- antiquities (1)

- Antonia Juhasz (2)

- AQI (1)

- Arent Fox Kintner Plotkin and Kahn (1)

- Ari Fleischer (1)

- Arizona (3)

- Arkansas (1)

- Arlen Specter (14)

- arms sales (3)

- Armstrong Williams (3)

- Arnold Schwarzenegger (1)

- art (3)

- asbestos (2)

- Atlanta (1)

- audio (2)

- AUMF 2002 (1)

- Australia (1)

- Bab al-Sheik (1)

- Baghdad (1)

- Bagram (1)

- bailout (4)

- Bakhtawar Zardari (1)

- Bangladesh (1)

- Baqouba (1)

- Barack Obama (43)

- Barbara Bush (5)

- Barry Jackson (1)

- Basra (2)

- BCCI (2)

- Bearing Point (1)

- bees (2)

- Ben Bernanke (1)

- Ben Nelson (2)

- Benazir Bhutto (7)

- benchmarks (3)

- Benita Fitzgerald Mosley (2)

- Benjamin Netanyahu (1)

- Big Agra (7)

- Big Business (2)

- Big Oil (12)

- Big Pharma (1)

- BigAgra (1)

- Bilawal Bhutto (2)

- Bill Clinton (19)

- Bill Clinton was no friend to liberals (1)

- Bill Gates (1)

- Bill Keller (1)

- Bill Kristol (2)

- Bill Maher (1)

- Bill Moyers (2)

- Bill Richardson (3)

- Bill Sammon (2)

- birds (1)

- Blackstone (2)

- Blackwater (11)

- blogging (4)

- Bob Baer (2)

- Bob Corker (1)

- Bob Graham (1)

- Bob Perry (1)

- Bob Shrum (1)

- Bobby Jindal (2)

- Bolivia (1)

- books (30)

- boys will be boys (1)

- BP (4)

- BP America (1)

- BP PLC (1)

- Brad Delong (1)

- Bradley Schlozman (1)

- Brazil (1)

- Bremer's 100 Orders (2)

- Brent Scowcroft (3)

- Brewster Jennings (1)

- Brian Schweitzer (1)

- Brigadier General Janis Karpinski (3)

- Bruce Bartlett (1)

- Bruce Fein (1)

- Bruce McMahan (2)

- Bud Cummins (1)

- Bulgaria (1)

- Bureau of Diplomatic Security (1)

- Burma (3)

- Bush (89)

- Bush 1 administration (2)

- Bush administration (98)

- Bush family (2)

- Bush veto (4)

- Bush-speak (1)

- Bush's legacy (5)

- Bush's surge (38)

- CAFTA (1)

- California (20)

- Cambodia (1)

- Camp Bucca (2)

- Camp Cropper (1)

- campaign contributors (1)

- Canada (1)

- cancer (1)

- candidates' positions (1)

- capitalism (3)

- Carl Levin (4)

- Carl Lindner (1)

- Carlyle Group (3)

- Carol Lam (1)

- Caroline Cheeks Kilpatrick (1)

- CBO (1)

- CBS (3)

- celebrity gossip (2)

- censorship (3)

- Centers for Disease Control (1)

- Chad (1)

- Chalmers Johnson (1)

- Charles Duelfer (2)

- Charles Grassley (6)

- Charles Koch (2)

- Charlie Rangel (1)

- charts (1)

- Chechnya (1)

- chemical industry (1)

- Chevron (3)

- ChevronTexaco (1)

- Chicago (2)

- children (1)

- China (12)

- Chip Reid (1)

- Chris Dodd (4)

- Chris Hedges (1)

- Chris Matthews (10)

- Chris Van Hollen (2)

- Christian Coalition (1)

- Christine Todd Whitman (3)

- Christopher Hitchens (1)

- Chuck Schumer (9)

- CIA (36)

- CIA leak investigation (4)

- CIA tapes (1)

- Cindy Sheehan (3)

- Citibank (1)

- civil liberties (4)

- civil rights (5)

- Claire McCaskill (1)

- Clarence Page (2)

- Clarence Thomas (1)

- Cleveland (1)

- climate change (8)

- Clinton administration (2)

- cluster bombs (3)

- CNN (1)

- coal (2)

- Coalition Provisional Authority (4)

- Cofer Black (2)

- Cold War (2)

- Colin Powell (5)

- Colleen Rowley (3)

- Colombia (1)

- Colonel Thomas M. Pappas (3)

- Colorado (3)

- Condoleeza Rice (5)

- Congo (1)

- Congressional Record (1)

- Connecticut (1)

- Conoco (1)

- ConocoPhillips (1)

- Conservatives (5)

- conspicuous consumption (12)

- Contempt of Congress (2)

- contractors (17)

- corn (5)

- corporate welfare (1)

- corruption (27)

- Council for National Policy (4)

- Council on Foreign Relations (1)

- CPA (9)

- Craig Crawford (2)

- Craig Fuller (1)

- Craig Thomas (1)

- crumbling infrastructure (1)

- Cuba (11)

- culture (22)

- Curveball (1)

- Cynthia Tucker (1)

- Cyril Wecht (1)

- Czech Republic (1)

- D and E/D and X/Partial Birth Abortion (2)

- D.C. voting rights (1)

- Dan Abrams (1)

- Dan Bartlett (2)

- Dan Burton (1)

- Dan Metcalfe (1)

- Dan Rather (1)

- Daniel Ellsberg (2)

- Daniel Inouye (1)

- Darrell Issa (2)

- David Addington (1)

- David Albright (2)

- David Broder (1)

- David Brooks (1)

- David Frum (1)

- David Gergen (2)

- David Gregory (8)

- David Gribben (1)

- David Horgan (1)

- David Kay (1)

- David Koch (2)

- David M. McIntosh (1)

- David MacMichael (2)

- David Rivkin (1)

- David Shuster (1)

- David Vitter (6)

- death penalty (2)

- death toll (1)

- debates (5)

- Debra Wong Yang (1)

- Defense Appropriations Subcommittee (1)

- Defense Authoriation Act of 2006 (1)

- Defense Policy Board (1)

- Deforest Soaries (3)

- Democracy Now (11)

- Democratic Party (4)

- Democratic Presidential debates (2)

- Democrats (9)

- Democrats suck too (39)

- Denmark (2)

- Dennis Kucinich (3)

- Department of Homeland Security (3)

- deregulation (17)

- derivatives (1)

- Det Norske Oljeselskap (1)

- detainees (2)

- Detroit (2)

- Diane Beaver (1)

- Dianne Feinstein (7)

- Dick Cheney (37)

- Dick Cheney's energy task force (4)

- Dick Durbin (4)

- Dick Lugar (2)

- dirty tricks (17)

- dissent (1)

- Diyala (1)

- DLC politics (1)

- DNO (2)

- documents (1)

- DoD (1)

- dogs (2)

- DOJ (5)

- domestic spying (1)

- Don Evans (4)

- Don Imus (6)

- Don Siegelman (1)

- Donald Rumsfeld (12)

- Douglas Brinkley (1)

- Douglas Feith (4)

- Dr. Justin Frank (1)

- draft (2)

- Drew Westen (1)

- drought (2)

- drug bill (1)

- drugs-illicit (4)

- drugs-pharmaceutical (1)

- Duncan Hunter (1)

- E.J. Dionne (1)

- earmarks (4)

- Ebay (1)

- economics (23)

- economy (81)

- Ecuador (1)

- Ed Markey (1)

- Ed Rogers (1)

- education (5)

- Egypt (2)

- Ehud Olmert (1)

- El Salvador (2)

- election 1980 (1)

- election 1992 (1)

- election 2000 (8)

- election 2002 (1)

- election 2008 (45)

- election reform (4)

- elections 2002 (2)

- elections 2004 (1)

- elections 2006 (4)

- elections 2008 (76)

- elections 2012 (1)

- electionws 2004 (1)

- Elian Gonzalez (1)

- Elijah Cummings (1)

- Elizabeth Dole (1)

- Ellen Tauscher (1)

- Elliot Abrams (1)

- email (4)

- ENDGAME (1)

- endorsements (3)

- energy (13)

- energy nuclear (2)

- energy nuclear (1)

- energy policy (6)

- entertainment (7)

- environment (59)

- environmental (1)

- EPA (3)

- Eric Edelman (1)

- Eric Holder (1)

- Eric Prince (2)

- Estonia (1)

- ethanol (1)

- ethics (2)

- Eugene Robinson (2)

- European Union (1)

- executive order 12334 (1)

- executive order 12472 (1)

- executive order 12656 (1)

- executive order 12958 (1)

- executive order 13228 (1)

- executive order 13233 (2)

- executive order 13303 (1)

- executive order 13315 (1)

- executive order 13350 (1)

- executive orders (8)

- Executive Privilege (4)

- Exxon (1)

- ExxonMobil (5)

- Fairness Doctrine (1)

- faith-based organizations (2)

- Fallujah (2)

- Fannie Mae and Freddie Mac (1)

- Farm Bill (5)

- Faye Williams (1)

- FBI (16)

- FCC (2)

- FDA (6)

- FDIC (1)

- FEC (1)

- Federal Reserve (4)

- Federalist Society (1)

- FEMA (1)

- filibuster (1)

- financial disclosure (1)

- first amendment (11)

- FISA bill (13)

- fish (3)

- flat tax (1)

- FOIA (1)

- food (46)

- For the children (2)

- For the common good (2)

- Foreign Intelligence cronyism (1)

- fourth amendment (1)

- Fox News (1)

- France (2)

- Frances Townsend (2)

- Frank Murkowski (1)

- Frank Rich (1)

- Frank Riggs (1)

- Fred Fielding (2)

- Fred Koch (1)

- Fred Thompson (15)

- free speech (3)

- free trade (1)

- freedom and democracy in Iraq (6)

- Freedom of Information Act of 2007 (1)

- Freedom to dissent...NOT (1)

- Freedom's Watch (2)

- Frontline (1)

- FUBAR (7)

- Futile Care Law (1)

- Gail Norton (2)

- GAO (7)

- gay rights (3)

- Gaza (2)

- Gazprom (1)

- gender inequality (4)

- Genel Enerji (1)

- General David Petraeus (6)

- General Electric (1)

- General Eric Shenseki (1)

- General Michael Hayden (6)

- General Tommy Franks (1)

- George H.W. Bush (10)

- George Lakoff (1)

- George P. Bush (1)

- George Tenet (15)

- George Voinovich (1)

- Georgia (7)

- Georgia Maryland (1)

- Georgia Pacific Corp. (1)

- Georgia Thompson (1)

- Germany (4)

- Getting To Know Your Adversary (1)

- Glass-Steagall Act of 1933 (1)

- Glenn Greenwald (1)

- global warming (20)

- globalization (2)

- GMO (2)

- Gonzales vs. Carhart (1)

- GOP (12)

- Gordon Brown (2)

- Governor Jim Doyle (1)

- Great Britain (22)

- Greg Thielmann (1)

- Grover Norquist (3)

- Guantanamo (20)

- Guatemala (1)

- Gulf of Mexico (2)

- Gulf War 1 (3)

- guns (2)

- H.R. 1255 (1)

- H.R. 1591 (1)

- H.R. 2206 (1)

- H.R. 3222 (1)

- H.R. 4156 (1)

- H.R. 4241 (1)

- Hague Regulations of 1907 (3)

- Haiti (1)

- Haley Barbour (1)

- Halliburton (6)

- Hamid Karzai (1)

- Hardball (16)

- Harold Ford Jr. (1)

- Harold Ickes (1)

- Harold Simmons (1)

- Harriet Miers (4)

- Harry Reid (9)

- Hatch Act (1)

- Hawaii (1)

- health (65)

- health care reform (1)

- health insurance (6)

- hearings (1)

- hedge fund managers (2)

- hedge funds (2)

- Helms-Burton Act (1)

- Henry Kissinger (1)

- Henry Paulson (3)

- Henry Waxman (8)

- Hezbollah (1)

- Hillary Clinton (62)

- holidays (2)

- homeland security (2)

- Homeland Security appropriations bill (1)

- House Appropriations Committee (3)

- House Committee on Intelligence (3)

- House Committee on Oversight and Government Reform (6)

- House Foreign Affairs Committee (1)

- House Judiciary Committee (5)

- House Natural Resources Committee (1)

- House Republicans (6)

- housing (1)

- Howard Fineman (3)

- Howard Wolfson (1)

- HR 1955 (1)

- HSPD 20 (2)

- Huffington Post (1)

- Hugo Chavez (2)

- human rights (13)

- Hungary (1)

- Hurricane Katrina (2)

- Hypocrisy 101 (4)

- Idaho (1)

- Ideas Whose Time Has Come? (1)

- illegal immigration (7)

- Illinois (3)

- IMF (4)

- impeachment (12)

- implosions (10)

- In our names (19)

- India (1)

- Indiana (4)

- Indonesia (1)

- insurgency (1)

- intelligence (9)

- Internet (7)

- interviews (19)

- Invocon (1)

- Iowa (3)

- IPO (1)

- Iran (27)

- Iran-Contra (1)

- Iran-Iraq war (1)

- Iraq (42)

- Iraq czar (1)

- Iraq elections (2)

- Iraq Health Ministry (1)

- Iraq occupation (2)

- Iraq Petroleum Company (1)

- Iraq reconstruction (5)

- Iraq Study Group (1)

- Iraq Survey Group (2)

- Iraqi army (1)

- Iraqi civilians (13)

- Iraqi Islamic Party (1)

- Ireland (1)

- Ishaqi (1)

- Islam (1)

- Israel (18)

- Issam Al-Chalabi (1)

- Italy (1)

- Iyad Allawi (1)

- Jack Abramoff (1)

- Jack Reed (2)

- James Baker (2)

- James Carville (3)

- James Comey (6)

- James Dobson (1)

- James Inholfe (1)

- James K. Haveman (1)

- James Schlesinger (1)

- James Sensenbrenner (1)

- James Woolsey (3)

- James Yousef Yee (1)

- Jan Schakowsky (1)

- Jane Dalton (1)

- Jane Harman (3)

- Japan (2)

- Jay Dardenne (1)

- Jay Leno (1)

- Jay Rockefeller (6)

- Jean Shaheen (4)

- Jean-Baptiste Aristide (1)

- Jean-Bertrand Aristide (1)

- Jeff Sessions (3)

- Jeffrey Toobin (1)

- Jennifer Fitzgerald (1)

- Jeremy Scahill (3)

- Jerrold Nadler (2)

- Jerry Lewis (1)

- Jesse Helms (1)

- Jesse Jackson (1)

- Jill Abramson (1)

- Jim Bunning (1)

- Jim DeMint (2)

- Jim Donelon (1)

- Jim Gilmore (1)

- Jim Hightower (2)

- Jim Marcinkowski (1)

- Jim McCrery (1)

- Jim McGovern (1)

- Jim Miklaszewski (1)

- Jim Moran (1)

- Jim O'Beirne (2)

- Jim Rogers (3)

- Jim VandeHei (1)

- Jim Webb (2)

- Jimmy Breslin (1)

- Jimmy Carter (1)

- Jo Ann Emerson (1)

- Joan Baez (1)

- Joe Allbaugh (1)

- Joe Biden (4)

- Joe Conason (3)

- Joe DiGenova (2)

- Joe Klein (1)

- Joe Lieberman (5)

- Joe Scarborough (1)

- Joe Wilson (9)

- John Ashcroft (7)

- John B. Taylor (1)

- John Barrasso (1)

- John Boehner (3)

- John Bolton (1)

- John Conyers (5)

- John Cornyn (1)

- John D. Bates (1)

- John Danforth (1)

- John Dean (2)

- John Dingell (2)

- John Edwards (9)

- John Gilmore (2)

- John Harris (2)

- John Harwood (2)

- John Kerry (3)

- John King (1)

- John McCain (11)

- John Mellencamp (1)

- John Murtha (3)

- John Nichols (2)

- John Roberts (4)

- John Sununu (3)

- John Warner (4)

- John Yoo (1)

- John Zogby (1)

- Joint Chiefs of Staff (2)

- Jon Corzine (1)

- Jonathan Alter (2)

- Jonathan Cohn (1)

- Jonathan Turley (1)

- Jordan (4)

- Jose Padilla (1)

- Joseph Stiglitz (1)

- Josh Bolten (2)

- Judith Miller (2)

- Judith Nathan Giuliani (1)

- K Street (2)

- Kamil Mubdir Gailani (1)

- Karbala (1)

- Karen Hughes (1)

- Karl Rove (25)

- Kate O'Beirne (2)

- Kazakhstan (1)

- Keith Olbermann (6)

- Ken Blackwell (1)

- Ken Mehlman (1)

- Ken Pollack (1)

- Ken Salazar (1)

- Ken Starr (1)

- Ken Wainstein (1)

- Kennedy family (1)

- Kenneth Blackwell (1)

- Kentucky (1)

- Ketchum (1)

- Khalid Sheik Mohammed (1)

- King Abdullah (1)

- Kit Bond (2)

- Kitty Kelley (1)

- knuckle-dragging Americans (1)

- Koch brothers (2)

- Koch Industries (1)

- KRG (1)

- Kristin Breitweiser (1)

- Kurdistan (3)

- Kurdistan Regional Government (2)

- Kurds (7)

- Kyle Sampson (1)

- L-1 Identity Solutions (1)

- Lamar Alexander (2)

- Lancet study (9)

- Lanny Griffith (1)

- Larry Craig (2)

- Larry Ellison (1)

- Larry Johnson (2)

- Larry Lindsey (1)

- Larry Summers (1)

- Larry Wilkerson (1)

- Las Vegas (3)

- Latvia (1)

- Laura Bush (1)

- Laurie David (1)

- Lawrence Korb (1)

- Leandro Aragoncillo (1)

- Lebanon (3)

- Lee Hamilton (1)

- legislation (30)

- Leon Panetta (1)

- Liberals (2)

- Libya (4)

- Lieutenant General Ricardo S. Sanchez (1)

- Lindsay Graham (6)

- Lisa Murkowski (1)

- lobbyists (6)

- Lockerbie (3)

- Lois Romano (1)

- London (1)

- long war (1)

- Loretta Sanchez (1)

- Lou Dubose (1)

- Louisiana (7)

- Lt. Colonel Steven Jordan (2)

- Lt. General Douglas Lute (2)

- Lt. General Martin Dempsey (1)

- Lt. General Ricardo Sanchez (1)

- Lukoil (1)

- Lynndie England (1)

- Madrid bombings (1)

- Mahdi Army (1)

- Mahmoom Khaghani (1)

- Maine (3)

- mainstream media (8)

- Major General Antonio Taguba (1)

- Major General Benjamin R. Mixon (1)

- Major General Geoffrey Miller (11)

- maps (1)

- Margaret Carlson (1)

- Marion Spike Bowman (2)

- Mark Corallo (1)

- Mark McKinnon (1)

- Mark Mix (1)

- Mark Penn (2)

- Mark Pryor (1)

- martial law (1)

- Mary Beth Buchanan (3)

- Mary Cheney (1)

- Mary Landrieu (1)

- Mary Matalin (2)

- Maryland (2)

- Massachusetts (2)

- Matt Brooks (1)

- Matt Cooper (1)

- Matthew Mead (1)

- Maury Wills (1)

- Max Baucus (1)

- media (15)

- Medicaid (1)

- medical ethics (1)

- Meet the Press (4)

- Meghan O'Sullivan (1)

- Mel Sembler (1)

- meltdown (16)

- men (1)

- mental health (11)

- mental illness (6)

- Mexico (4)

- Michael Allan Leach (1)

- Michael Bloomberg (1)

- Michael Chertoff (6)

- Michael Eric Dyson (1)

- Michael Garcia (1)

- Michael Ledeen (1)

- Michael Moore (4)

- Michael Mukasey (13)

- Michael O'Hanlon (2)

- Michael Pollan (7)

- Michael R. Gordon (2)

- Michael Scheuer (2)

- Michael Steele (1)

- Michael Turk (1)

- Michelle Obama (1)

- Michigan (2)

- Mickey Herskowitz (1)

- Middle East (15)

- Mike Barnicle (1)

- Mike Huckabee (9)

- Mike McConnell (3)

- Mike Mullen (1)

- military budget (5)

- Military Commissions Act of 2006 (1)

- military equipment (15)

- Military Industrial Complex (4)

- military tribunals (1)

- Milwaukee (1)

- Minnesota (2)

- Mississippi (2)

- Missouri (1)

- Mitch McConnell (4)

- Mitt Romney (9)

- Molly Ivins (2)

- moments in history (1)

- Monica Goodling (1)

- Monica Lewinsky (1)

- Montana (3)

- Most Ethical Congress (1)

- MoveOn.org (2)

- movies (2)

- MSNBC (3)

- multinational corporations (2)

- Murray Waas (2)

- N. Korea (4)

- NAFTA (3)

- Najaf (1)

- Nancy Pelosi (16)

- Naomi Klein (10)

- Naomi Wolf (1)

- narcissistic personality disorder (1)

- Nat Parry (1)

- National Defense Authorization Act for 2008 (4)

- National Guard (2)

- National Republican Congressional Committee (1)

- National Security (1)

- National Security Archive (2)

- National Security Decision Directive 188 (1)

- Neil Bush (2)

- Nelson Cohen (3)

- Neoconservatives (4)

- Netherlands (1)

- Nevada (1)

- New Afghanistan (3)

- New Hampshire (8)

- New Iraq (51)

- New Jersey (1)

- New Orleans (1)

- New World Order (9)

- New York (7)

- New York Times (5)

- New Yorker (1)

- Newsweek (8)

- Newt Gingrich (2)

- NIE (4)

- NIH (1)

- Ninth Circuit Court of Appeals (2)

- No Child Left Behind (1)

- No WMD (2)

- Noam Chomsky (1)

- Norm Coleman (1)

- North Carolina (3)

- Now That Obama's President - What's Left To Do? (1)

- NRC (1)

- NRCC (1)

- NSA (6)

- NSL (2)

- NSPD 51 (2)

- nuclear (12)

- Obama administration (10)

- obituaries (2)

- oceans (4)

- offshoring (1)

- Ohio (3)

- oil (14)

- oil and gas (20)

- oil law (21)

- Oklahoma (1)

- Oliver North (1)

- Olympia Snowe (1)

- OPEC (3)

- Operation Clean Break (1)

- Operation Rescue (1)

- Oprah Winfrey (1)

- Order 37 (2)

- Order 39 (3)

- Order 40 (1)

- Oregon (1)

- organic farming (1)

- organized labor (7)

- Orrin Hatch (1)

- Osama Bin Laden (9)

- outsourcing (1)

- owls (1)

- PACS (1)

- Pakistan (15)

- Pakistan's People's Party (2)

- Palestinians (2)

- Pan Am 103 (2)

- Paris Hilton (2)

- parliamentary procedure (1)

- passportgate (2)

- Pat Buchanan (4)

- Pat Leahy (2)

- Pat Roberts (4)

- Pat Tillman (2)

- Patrick Lang (1)

- Patrick Leahy (10)

- Patrick McHenry (1)

- Patriot Act (12)

- Patty Murray (1)

- Paul Allen (1)

- Paul Bremer (9)

- Paul Craig Roberts (1)

- Paul Eaton (1)

- Paul Krugman (8)

- Paul O'Neill (1)

- Paul Rieckhoff (2)

- Paul Wellstone (1)

- Paul Weyrich (1)

- Paul Wolfowitz (5)

- PDVSA (1)

- Peak oil (2)

- Pennsylvania (4)

- Pentagon (22)

- people (1)

- Pervez Musharraf (10)

- Pete Domenici (1)

- Peter King (1)

- Petoil (1)

- Petrel Resources (1)

- Phil Gingrey (1)

- Phil Giraldi (1)

- Phil Griffin (1)

- Philip Atkinson (1)

- Philip Zelikow (1)

- Phillipines (2)

- photos (66)

- Phyllis Schlafly (1)

- PKK (1)

- Plan B (1)

- PNAC (1)

- Poland (1)

- police brutality (2)

- political fundraising (1)

- political operatives (1)

- polls (4)

- population control (1)

- Porter Goss (2)

- poverty in America (3)

- Presidential candidates (8)

- Presidential Directives (1)

- Presidential pardons (1)

- Presidential Records Act of 1978 (6)

- press releases (1)

- prewar intelligence (1)

- Prince Bandar bin Sultan (2)

- prisons (6)

- privacy (15)

- Privacy Act of 1974 (1)

- private contractors (1)

- private equity (2)

- privatization (20)

- Profiles (11)

- Project Checkmate (1)

- propaganda (4)

- Protect America Act (2)

- PSA (1)

- psychologists (1)

- Psychology Today (1)

- PTSD (1)

- public relations (1)

- Puerto Rico (2)

- Pulitizer prizes (1)

- Putin (3)

- QinetiQ (1)

- Quds (1)

- race card (7)

- Rachel Maddow (3)

- racism (4)

- Rahm Emanuel (1)

- Ramadi (1)

- Ramzi Yousef (1)

- Rand Corporation (2)

- Ray McGovern (6)

- Reagan administration (1)

- real estate (2)

- Reasons not to vote for Republicans (22)

- Reasons we need campaign finance reform (7)

- recess appointment (1)

- red flags (1)

- reference file (1)

- reference papers (1)

- refugees (3)

- religion (3)

- rendition (2)

- reports (1)

- Republican Party (3)

- Republicans (15)

- Richard Armitage (1)

- Richard Baker (1)

- Richard Clarke (1)

- Richard E. Stickler (1)

- Richard Mellon Scaife (2)

- Richard Nixon (2)

- Richard Perle (6)

- Richard Viguerie (1)

- Richard Wolffe (1)

- Rick Santorum (1)

- right-wing organizations (2)

- RNC (7)

- Robert Dreyfuss (1)

- Robert F. Kennedy Jr. (2)

- Robert Fisk (1)

- Robert Gates (9)

- Robert Johnson (1)

- Robert Kuttner (1)

- Robert Mueller (10)

- Robert Novak (3)

- Robert Parry (6)

- Robert Reich (1)

- Rodney Alexander (1)

- Roger Simon (2)

- Roger Stone (2)

- Romania (1)

- Ron Brownstein (2)

- Ron Paul (3)

- Ron Reagan (1)

- Ron Suskind (1)

- Ron Wyden (1)

- Ronald Reagan (3)

- Roslynn Mauskopf (1)

- Royal Dutch Shell (3)

- Royal Dutch/Shell Group of Cos. (1)

- Rudy Giuliani (5)

- Rudy Guiliani (1)

- rule of law (8)

- Rush Holt (1)

- Russ Feingold (2)

- Russell Feingold (1)

- Russell Simmons (1)

- Russia (4)

- Rwanda (1)

- Ryan Crocker (3)

- S. 1927 (4)

- S. 1932 (1)

- S. 2340 (1)

- S. Carolina (4)

- S. Dakota (1)

- S. Korea (1)

- Sabrina D. Harman (1)

- Saddam Hussein (3)

- Sadr City (1)

- SAIC (1)

- Sam Bodman (1)

- Sam Brownback (2)

- Samarra (2)

- San Francisco (4)

- sanctions (1)

- Sandra Day O'Connor (2)

- Sara Taylor (4)

- Sarah Palin (7)

- Sarkozy (1)

- Saudi Arabia (17)

- Savings and Loan crisis (3)

- science (2)

- Scooter Libby (8)

- Scott Ritter (2)

- SEC (1)

- secrecy (12)

- secret government (2)

- secret holds (1)

- secret prisons (4)

- Secret Service (3)

- secular democracy (1)

- Senate Appropriations subcommittee (2)

- Senate Armed Services Committee (3)

- Senate Energy and Commerce Committee (1)

- Senate Ethics Committee (1)

- Senate Finance Committee (2)

- Senate Intelligence Committee (6)

- Senate Judiciary Committee (22)

- Senate Republicans (1)

- senior issues (2)

- Separation of church and state (8)

- Sergeant Michael J. Smith (1)

- Sergeant Santos A. Cardona (1)

- sex (1)

- sex crimes (1)

- Seymour Hersh (7)

- Sheldon Adelson (2)

- Shell Oil (6)

- Sheryl Crow (1)

- Shiite militias (1)

- shrines (2)

- Sibel Edmonds (1)

- Sibiyha Prince (1)

- Sidney Blumenthal (2)

- SIGIR (1)

- signing statements (1)

- Slovakia (1)

- slow food (2)

- socialism (1)

- SOFA (1)

- Spain (2)

- Special Inspector General for Iraq Reconstruction (1)

- special ops (1)

- Specialist Charles Graner (1)

- speeches (2)

- Stephen Cambone (1)

- Stephen Hadley (8)

- Steve Capus (2)

- Steve Fraser (1)

- Steve McMahon (2)

- Steve Scalise (1)

- Steven Biskupic (1)

- Stuart Bowen (1)

- summer reading list (1)

- Sunni (2)

- sunshine laws (1)

- superdelegates (2)

- supplemental appropriations bill (9)

- Susan Collins (2)

- Susan Page (1)

- Susan Ralston (1)

- Swift Boat veterans (1)

- Swift Boat Veterans for Truth (1)

- Syria (13)

- T. Boone Pickens (1)

- Taguba report (2)

- Talabani (2)

- Taliban (2)

- TALON (1)

- TANG (1)

- taxes (1)

- Ted Kennedy (1)

- Ted Olson (1)

- Ted Stevens (2)

- Telecommunications Act (1)

- Telecoms (2)

- Tennessee (1)

- terrorism (12)

- Terrorist Surveillance Program (6)

- Terry McAuliffe (1)

- Terry O'Donnell (1)

- Texas (11)

- Thailand (1)

- The Fellowship (1)

- think tanks (3)

- Thom Hartmann (1)

- Thomas B. Edsall (1)

- Thomas Blanton (1)

- Thomas Edsall (1)

- Thomas J. Collamore (1)

- Thomas M. Tamm (1)

- Tim Geithner (7)

- Tim Griffin (1)

- Tim LaHaye (1)

- Tim Russert (2)

- Tim Ryan (1)

- Timothy P. Berry (1)

- Todd Graves (1)

- Todd Palin (3)

- Tom Allen (1)

- Tom Andrews (1)

- Tom Brokaw (1)

- Tom Coburn (1)

- Tom Coburt (1)

- Tom Daschle (1)

- Tom Davis (4)

- Tom DeLay (2)

- Tom Harkin (1)

- Tom Lantos (1)

- Tom Maertens (1)

- Tom Oliphant (1)

- Tom Tancredo (1)

- Tom Vilsack (1)